02 July 2019

The European Banking Authority (EBA) presented the results of its Basel III implementation assessment in a public hearing on 2 July.

This includes a quantitative impact study (QIS) based on data from 189 EU banks, and a comprehensive set of policy recommendations in the area of credit and operational risk, output floor and securities financing transactions.

This work, which responds to a Commission's call for advice, shows that the full implementation of Basel III in the EU, under the most conservative assumptions, increases the weighted average minimum capital requirement (MRC) by 24.4%, leading to an aggregate capital shortfall of EUR 135.1 bn for large global banks.

The impact on medium-sized banks is limited to 11.3% in terms of MRC, leading to a shortfall of EUR 0.9 bn, and on small banks to 5.5% MRC with a EUR 0.1 bn shortfall.

The EBA will publish the full report by the end of July (for the full article, we refer you to the following link).

The capital shortfall can be addressed in many ways.

Banks can issue new shares, decrease their lending business or try to use the balance sheets of third parties through securitisation.

The latter can be a cheaper solution than the issuance of new capital and supports continuation of lending.

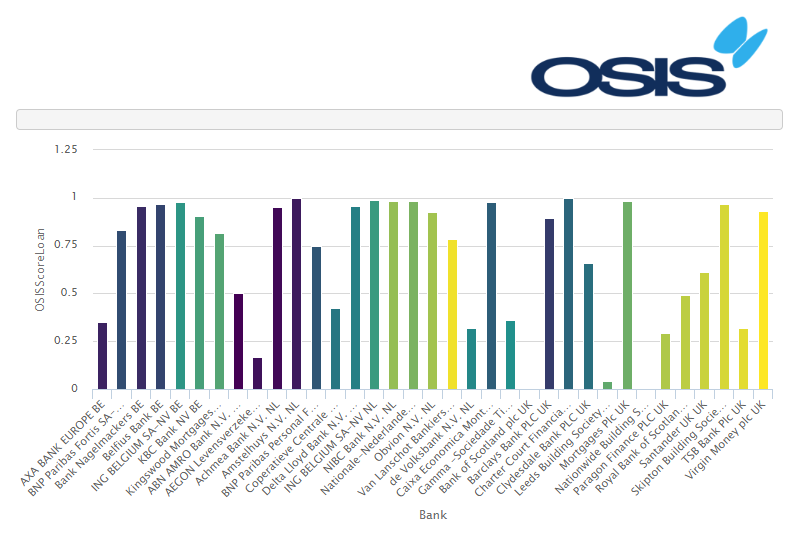

OSIS did a research in consultation with members of the IACPM on the use of synthetic securitization.

In this research, we have seen that asset classes like SME, Commercial Real Estate and Large Corporate lending in several jurisdictions would be an interesting alternative for capital issuance to decrease the capital shortfall.

OSIS can support both banks and investors to analyse the value of these trades from both perspectives.