Loan Qualifier for ESMA

Clean, consistent and reliable data is of the essence and drives the ability of lenders and investors to make informed decisions. To this end we support our clients continuously with analysis, monitoring of the quality of large loan portfolios like the ESMA requirements for securitisations.

OSIS™ supports lenders and investors with data quality services on loan portfolios for securitisations. We provide a secure online tool to validate standardized loan level data and transaction level files in compliance with the templates and taxonomies published by ESMA for securitization transactions. The OSIS Loan Level Data Portal enables originators and investors to validate loan files in Microsoft Excel format and transform the file into XML meeting all the ESMA requirements. The portal returns a detailed valuation log (available for download) helping users to validate compliance with ESMA requirements and to improve the completeness, accuracy and consistency of their data of loan, collateral, tenants and transaction level.

ESMA regulations

All securitisations issued after 1 January 2019 need to meet the disclosure requirements defined by ESMA.

That means in practice that issuers need to report within 4 weeks after the first reporting date following 23 September 2020.

All securitisations means both public and private, non ABCP and ABPCP transactions.

However, there are different data templates required for different categories:

- For all (both public and private) non-ABCP securitisations: Annexes 2 until 10 with information on loan, tenant and collateral level (as applicable depending on the type of underlying exposure) and Annex 12 on transaction level are applicable.

- For all (both public and private) ABCP securitisations: Annexes 11 and 13 are applicable.

- In addition, for public deals issuers have to report:

- For non-ABCP securitisations: Annex 14

- For ABCP securitisations: Annex 15

Data validation

The data need to be delivered in an XML format linked to a large range of data quality rules programmed in an

XSD file also provided by ESMA. With XSD file any user can easily validate each XML file and check whether the files

meet the formats and data quality rules of ESMA. However, the XSD validation test provides limited information to the

issuer about where errors reside in order to correct them.

Therefore, OSIS offers a validation log file which identifies each cell (combination of a field and loan/collateral)

which contains errors and explains why it is an error.

The process

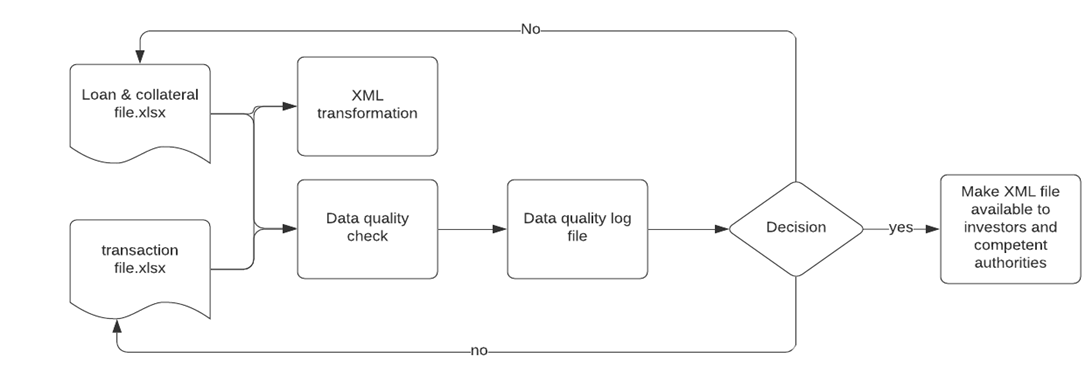

The user enters the OSIS portal by filling in its credentials.

The user selects the asset class of the transaction in question. Currently we support Corporates, RMBS, CMBS, Autos,

Credit Cards, Esoteric and Consumer loans. The user drags separately the file on loan/collateral level (annex 2-10)

and the file on transaction level to the portal.

The portal will read and validate the files and after a few minutes generates an XML file and a data quality log file.

The XML will be created irrespective whether the file is valid or not. The user will receive a validation message.

On the basis of the data quality log file it can analyze the quality of the file and decide whether it needs to adjust

the original xlsx file, upload and validate it again on the portal.

Contact

We would welcome the opportunity to discuss your requirements and see how we can assist, please email jeroen.batema@os-is.com or contact him on +31 70 32 60 370.